Debunking the Underperformance Myth: Why CareTrust REIT Continues to Win

"Get The Best Of Both Worlds With This REIT: Income & Growth"'

As you know by my name, I love dividends. And in addition to sharing on here, I write regularly on the investment platform- Seeking Alpha.

My goal there is to teach everyday investors about building wealth, so they won’t to need to work to traditional retirement age.

I want to help you take control of your life, have F.I.R.E.

Here at Dividend Collection Agency the goal is to give investors and/or readers a different perspective. We take a simple approach to building wealth. And although investing may seem easy, people often miss opportunities by over complicating it. But we are here to help.

Current Price: $37.49

Portfolio Purpose: Income 💰

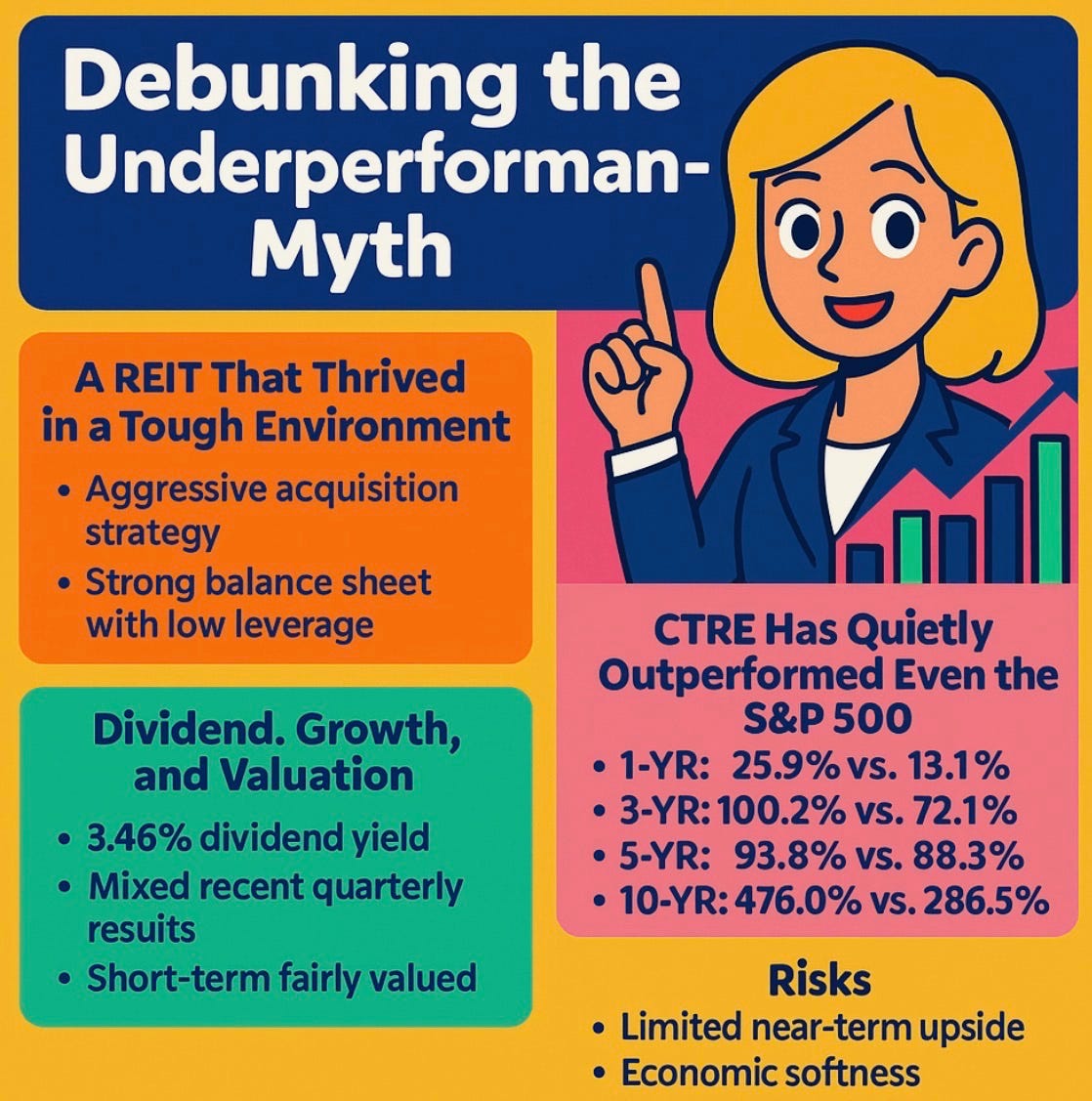

Most investors have heard the story that REITs are “chronic underperformers.” And while a higher-for-longer interest rate environment does create challenges, CareTrust REIT (CTRE) has been a major exception to the narrative.

Since September 2023, the stock has gained nearly 86%, compared to roughly 53% for the S&P 500 over the same period.

So, while many REITs struggled in recent years, CTRE has completely debunked the underperformance myth. And with interest rates expected to trend lower over the next 12–24 months, CTRE may still have some room to run.

A REIT That Thrived Despite a Tough Environment ⚖️

CTRE’s recent success is rooted in its aggressive yet disciplined investment strategy. While many REITs slowed activity due to economic uncertainty, CareTrust REIT pushed forward, completing over $1.5 billion in acquisitions year-to-date.

Their most recent deal—a $27 million cash acquisition of two U.K. care homes—signals continued international expansion.

Today:

• The U.K. represents 15.1% of annualized base rent

• California remains the largest contributor at 19.5%

What truly sets CTRE apart is its exceptionally strong balance sheet:

• Net debt to EBITDA: 0.4x (amongst the lowest in the entire REIT sector)

• No meaningful debt maturities until 2028

• More than $300M in cash + $1.2B in revolving credit capacity

This financial flexibility positions the company to continue investing aggressively into 2026 and beyond.

CTRE Has Quietly Outperformed Even the S&P 500 📉

Healthcare REITs are typically viewed as defensive, and not market beaters. But CTRE has quietly outperformed the S&P 500 across nearly every major timeframe.

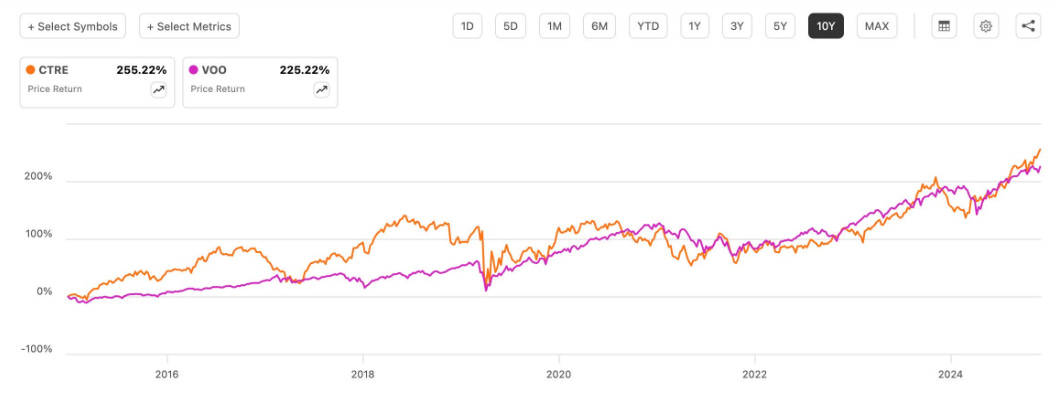

1-Year Total Return: CTRE: 25.93% & VOO: 13.15%

10-Year Price Return: CTRE: 255.22% & VOO: 225.22%

10-Year Total Return: CTRE: 476.03% & VOO: 286.51%

This level of outperformance is unusual for a REIT. Especially, one with conservative leverage and a methodical acquisition strategy.

Dividend, Growth, and Valuation 💸

CTRE’s current dividend yield sits at 3.46%—lower than peers like Realty Income (O) or Agree Realty (ADC). But the lower yield reflects strong price appreciation and a structurally lower cost of capital.

Their latest quarterly results came in mixed:

• FFO missed by $0.02

• Revenue beat by ~$10M, growing 71% YoY

• FAD per share increased from $0.37 to $0.45

• Payout ratio remains healthy at 74%

• Acquisition pipeline stands at ~$600M

Despite an FFO miss, all major operational metrics grew meaningfully.

Valuation Check ✔️

Using management’s midpoint FFO guidance of $1.765, CTRE trades at a 21.26x forward FFO multiple, which is well above its historical norm of ~14x.

Even assuming a new valuation band between 18x–20x due to stronger growth, shares today look fairly valued.

• My attractive buy zone: ~$30–32

• Current price (~$38): pricing in most near-term upside

Wall Street’s price target of ~$40 doesn’t leave much margin of safety.

Key Risks to Watch ⚠️

While the long-term thesis remains strong, several risks could affect future returns:

Limited Near-Term Upside: After such strong outperformance, CTRE’s valuation already reflects higher expectations.

Economic Softness: An uptick in unemployment could signal weaker economic conditions into 2026, potentially reducing acquisition activity.

Recession Probability: If the U.S. enters a recession, deal flow may slow materially, limiting growth over the next few years.

Ultimately, CTRE is financially well-positioned, but lower activity would naturally constrain returns.

Bottom Line ✅

I remain cautiously bullish on CareTrust REIT. Lower interest rates should provide a tailwind, and CTRE’s balance sheet strength gives it unmatched flexibility to pursue growth opportunities.

However, with shares trading above historical multiples, investors seeking a margin of safety may want to wait for a pullback closer to the $30 range.

Long term, I still view CTRE as a high-quality REIT capable of compounding value. But expectations for outsized outperformance should be tempered at today’s valuation.

Happy Investing!

If you’re looking to create passive income and build your wealth from one of the top rated analysts, book a call (Let’s Talk Investing or Detailed Portfolio Review) with me to get started. ☎️

If you’re looking to start investing check out our investment group over on Seeking Alpha. Click the Seeking Alpha link here. Click investing group, learn more, or the blue hyperlink in my bio.

Not financial advice. For educational purposes only. I am not a licensed professional. Do your own due diligence.

Like & subscribe if you’re active duty, a veteran, or just love investing.

Brilliant breakdown on CTRE's performance against the broader market. The 0.4x net debt to EBITDA ratio is genuinly remarkable, especially when most REITs are levereged way higher. One angle worth considering though: if rates drop faster than expected in 2025, could the aggressive acquisition pipeline actually create integration risk? At 21x forward FFO, theres almost zero room for execution misses.